What’s the Lowest Credit rating to possess Rocket Home loan?

Comments Off on What’s the Lowest Credit rating to possess Rocket Home loan? Jul 20, 2024 | availableloan.net+installment-loans-ga+kingston how much interest on a cash advance

Rocket Financial are supported by Quicken Financing, which includes an extremely powerful cover and research privacy platform. A few of the security measures that they have fun with include SSL deal method and you will top-edge 128-portion encryption technology.

Seeing as Quicken Money utilizes more than twenty four,100000 people, you can rest assured that they have a devoted defense people which is doing work 24 hours a day to keep your studies safer.

Customer support and you will Service

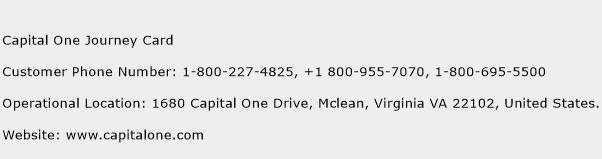

Present or pending consumers possess cellular phone support access from Friday as a consequence of Friday at step one-888-452-8179. New clients normally reach a real estate agent Tuesday because of Week-end within 1-800-689-9155.

Alive chat is additionally available seven days per week. For much more details about its alive speak call center occasions, head to their Communicate with All of us webpage.

Pros and cons out-of Rocket Mortgage

- Very easy-to-have fun with application for the loan procedure

- Very fast; you can literally score pre-recognized contained in this 10 minutes

- Amazing cellular software that make it less difficult to apply for a mortgage

- Versatile customer service choice

- You may be capable negotiate a much better deal with good shorter from inside the-people financial

- Cannot be utilized for of a lot multiple-nearest and dearest industrial attributes

- No brick-and-mortar branches

Choices so you can Rocket Home loan

There are a few on the web-merely lenders. However, none of them is actually as big as Skyrocket Mortgage, that makes experience because it is backed by Quicken Loans.

- SoFi

- Financing Depot

Rocket Mortgage Faq’s

For a normal loan, you will want a rating of at least 620. You could be eligible for a normal mortgage which have a get all the way down than simply 620, in that instance, you could be considering a top-interest rate. To possess a Va mortgage, Skyrocket Mortgage need a rating away from 620 otherwise most useful. Getting an enthusiastic FHA loan, you may need a get of 580 otherwise ideal.

How does Rocket Home loan Performs?

Skyrocket Home loan try an online mortgage lender. After you sign up for a merchant account, you might apply for that loan. Then you’ll definitely understand if you’ve been approved. When you are accepted and you will proceed toward mortgage, Skyrocket Mortgage often provide your money and you will charges focus same as a traditional mortgage lender monthly installment loans Kingston GA.

Is actually Quicken Loans the same as Rocket Mortgage?

Yes. These represent the same providers. Quicken Money has Rocket Home loan. Quicken Financing ‘s the largest home loan company regarding U.S.

Is Rocket Mortgage a challenging Inquiry?

Making an application for home financing which have Rocket Mortgage, or with people financial, demands a hard credit remove. Simply because the financial institution must make certain your revenue and you may conduct an in depth breakdown of your credit report.

While interested in learning your credit score is-and you should know your credit rating before you apply to have a great mortgage-I would recommend checking it 100% free during the a webpage particularly AnnualCreditReport otherwise Borrowing Sesame.

Very, Was Rocket Financial the best option in my situation?

When you find yourself the sort of person who likes to carry out acts on the internet, therefore wish to rating things over quickly, Rocket Financial is probable a good option. Imagine if you just found your perfect house and you may you want and make a deal before you leave the newest appearing. You could conceivably rating an excellent pre-recognition out of Rocket Home loan correct over the phone before conference along with your agent comes to an end.

On top of that, if you’re looking purchasing a multiple-family device or low-antique assets, Skyrocket Home loan might not be for your requirements. (To see regarding the my home investing information, read through this.)

If you are the type of individual that prefers face-to-face relations, you could potentially love to run an area bank on your own city. In addition might have more discussing feature having a smaller sized bank than you might provides with Rocket Home loan.